Indicadores

| Título del ítem | Sumario | Categorías | Creado | |

|---|---|---|---|---|

| ¿Qué será del vino en 2023? estos son los desafíos y oportunidades para el sector |

Según un reciente análisis de la consultora IWSR, el sector del vino se enfrenta a múltiples desafíos en el corto y mediano plazo, y aunque a largo plazo la tendencia es hacia una disminución de los volúmenes en muchos mercados, se esperan oportunidades en el comercio electrónico, vinos premium, espumosos y alternativos. El sector del vino se encuentra en un momento de incertidumbre económica que está llevando a los consumidores en muchos mercados a reducir su gasto discrecional, especialmente en la hostelería. A pesar de ello, el número de bebedores regulares de vino ha aumentado nuevamente, impulsado por el regreso de algunos consumidores adultos más jóvenes a la hostelería. En este contexto, IWSR identifica los principales desafíos del sector del vino en 2023 y más allá. En primer lugar, el vino es una categoría en lento declive a nivel mundial, y hay pocas señales de que esto cambie en el corto plazo. Aparte de las bebidas listas para beber (RTD) con base de vino, todas las categorías de bebidas experimentaron una caída en las ventas desde el año de la pandemia en 2020. Mientras que los licores están recuperándose con fuerza y la cerveza está ganando terreno en los mercados en desarrollo, la disminución a largo plazo del vino ha continuado. En los primeros semestres de 2021-2022, los volúmenes de vino disminuyeron un -5%, y de los 20 principales mercados de vino, solo Brasil está bebiendo más vino ahora que antes de la pandemia. Además, en muchos de los principales mercados, el número de adultos que se clasifican como bebedores regulares de vino sigue disminuyendo, especialmente en el segmento de jóvenes de menos de 34 años. Una mayor dependencia de los bebedores mayores, que en su mayoría están arraigados en sus hábitos, y los desafíos continuos para reclutar nuevos consumidores sugieren que los productores de vino necesitarán innovar para capturar la participación de los bebedores más jóvenes. A pesar de esto, el comercio electrónico y el vino espumoso son dos áreas donde se espera que el sector del vino tenga oportunidades de crecimiento. Al igual que muchos otros bienes de consumo, el vino experimentó un aumento en el comercio electrónico durante la pandemia, con muchos consumidores haciendo pedidos online de vino por primera vez. Aunque se temía que este comportamiento disminuyera una vez que el mundo regresara a la normalidad, las tasas de participación post-Covid se mantienen estables o en aumento. En muchos mercados clave, aunque el crecimiento del comercio electrónico de vino está moderando, la participación online en las ventas de alcohol está en aumento. Además, se espera un mayor crecimiento en mercados como los Estados Unidos, Canadá y Brasil, donde hasta un tercio de los bebedores de vino que actualmente no hacen pedidos online están abiertos a la idea de hacerlo. En cuanto al vino espumoso, la falta de oportunidades en el mercado del vino podría ser compensada por el aumento en la demanda de vinos espumosos en todo el mundo. Los vinos espumosos, especialmente aquellos producidos en la región de Champagne en Francia, se están volviendo cada vez más populares y están ganando cuota de mercado en muchos mercados clave. Se espera que este crecimiento se mantenga en el futuro cercano, ya que los consumidores buscan bebidas más lujosas y con mayor valor percibido. Por otro lado, los vinos alternativos, incluidos los vinos orgánicos, naturales y veganos, también podrían presentar una oportunidad de crecimiento para los productores de vino. Los consumidores cada vez son más conscientes de la sostenibilidad y la salud, y están dispuestos a pagar más por productos que reflejen sus valores personales. A medida que los consumidores jóvenes y los bebedores ocasionales se sienten más atraídos por estos productos, se espera que los productores de vino que ofrezcan alternativas atractivas puedan aumentar su participación en el mercado. En este sentido, el consumo moderado se ha convertido en una tendencia importante en el sector de bebidas a nivel mundial, y esto ha llevado a una mayor demanda de opciones de vino con menos alcohol. Aunque el vino sin alcohol ha tenido dificultades para ser aceptado en muchos mercados debido a su sabor y calidad, la tecnología ha permitido mejoras significativas en este aspecto. Sin embargo, es el vino bajo en alcohol el que está liderando el camino en mercados clave como Estados Unidos, Alemania, Japón y el Reino Unido. Los bebedores jóvenes de vino son particularmente propensos a reducir su consumo de alcohol, lo que sugiere que la tendencia hacia el vino bajo en alcohol es probable que continúe en el futuro cercano.

La tendencia de "menos pero mejor" se consolida en el sector del vino y ofrece oportunidades para los vinos de alta gama que están superando en ventas a los de precios más bajos, una realidad que se espera que continúe. Este fenómeno es especialmente evidente en los vinos espumosos, pero también se está observando en los vinos tranquilos, aunque de manera más moderada. A pesar de un aumento del volumen global de vinos tranquilos premium de menos del 1% en el primer semestre de 2022, este crecimiento es una clara diferencia a la tendencia decreciente del sector del vino en general. La preferencia de los consumidores por vinos más caros pero menos frecuentes es una tendencia que se espera que continúe. Desde IWSR, recomiendan a los productores de vinos premium y alternativos que ajusten sus precios para seguir siendo competitivos en el mercado y capitalizar esta tendencia al alza en el consumo de vinos de alta calidad. Por último, el vino se enfrenta a incertidumbres económicas en 2023. La confianza del consumidor es uno de los principales desafíos que enfrentará el sector vinícola en el próximo año, debido a la desaceleración económica global. A pesar de que la mayoría de los bebedores de vino confían en su capacidad para manejar sus finanzas personales, muchos están optando por reducir sus gastos en vino. Los europeos son particularmente pesimistas, con la expectativa de comprar menos vino y vino más barato en el futuro cercano. Además, la mayoría de los consumidores, incluso en el optimista mercado estadounidense, esperan salir menos en los próximos 12 meses. Aunque los consumidores chinos son una excepción en este sentido, su optimismo podría estar influenciado por su reciente salida de un largo y severo bloqueo. En general, el sentimiento del consumidor apunta a una población mundial de bebedores de vino que es optimista a largo plazo, pero cautelosa a corto plazo, especialmente en Europa. Después de haber retomado la socialización tras la pandemia de Covid, ahora están considerando un período de retraimiento. En conclusión, aunque el sector del vino se enfrenta a múltiples desafíos en el corto y mediano plazo, existen oportunidades para el crecimiento a largo plazo en el comercio electrónico, los vinos espumosos y los vinos alternativos. Para capitalizar estas oportunidades, los productores de vino necesitarán innovar y adaptarse a las cambiantes demandas de los consumidores, especialmente aquellos en el segmento más joven del mercado. |

Mundial | Mercados | Vitivinícola | Clientes | Sábado, 11 Marzo 2023 | |

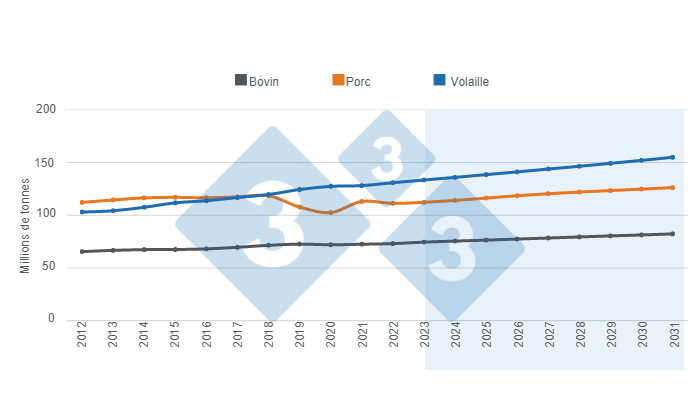

| Long-term projections for global meat production |

333 Latin America with data from The United States Department of Agriculture (USDA). |

Mundial | Mercados | Cárnicos | Producción | Viernes, 10 Marzo 2023 | |

| Comité Champagne presenta su estrategia a 10 años: ¿cómo afectará al mercado del champán? |

El Comité Champagne, organismo que representa a los productores y elaboradores de este vino espumoso en la región de Champagne, ha presentado sus planes para los próximos 10 años en su última reunión. Con un fuerte enfoque en la sostenibilidad y la innovación, el Comité Champagne se propone enfrentarse a los desafíos de la industria del champagne en el siglo XXI. La producción de champagne es una industria tradicional que se remonta a varios siglos, y ha enfrentado una serie de desafíos en los últimos años. La viticultura intensiva y el alto uso de pesticidas han sido algunos de los factores que han puesto en riesgo la sostenibilidad del champagne, y la innovación en la industria ha sido limitada. Es por ello que el Comité Champagne ha establecido objetivos ambiciosos para la próxima década. En primer lugar, el Comité Champagne se ha comprometido a reducir en un 50% el uso de pesticidas en la producción de champagne para el año 2030. Además, también busca reducir en un 75% la huella de carbono de la producción de champagne para el año 2050, lo que significa una reducción significativa en las emisiones de gases de efecto invernadero. Para lograr estos objetivos, el Comité Champagne ha establecido medidas como la promoción de la viticultura sostenible y la protección de la biodiversidad, el desarrollo de prácticas de cultivo más eficientes y el uso de energías renovables en la producción de champagne. Otro objetivo clave del Comité es fomentar la innovación en la industria del champagne. La organización ha establecido un programa de investigación y desarrollo para nuevas técnicas de vinificación, con el fin de mejorar la calidad del vino y fomentar la creatividad en la producción de champagne. Además, el organismo ha lanzado un programa de incubación para startups de champagne, que brinda apoyo y recursos a las nuevas empresas que buscan innovar en la industria del champagne. Con este programa, el Comité Champagne espera fomentar la creatividad y el emprendimiento en la región . En línea con la importancia de la cultura y la historia del champagne, el Comité también está trabajando en la promoción y preservación de la tradición del champagne. Se están implementando programas educativos y turísticos para promover la región y la cultura del vino espumoso más famoso del mundo, y se está trabajando para aumentar la conciencia sobre la importancia de la tradición del champagne y su impacto en la región. El Comité Champagne ha establecido una visión ambiciosa para la próxima década, con un fuerte enfoque en la sostenibilidad y la innovación. La organización busca enfrentar los desafíos de la industria del champagne y garantizar su sostenibilidad a largo plazo. Con estos planes, el Comité Champagne espera no solo proteger la producción de champagne, sino también fomentar el desarrollo sostenible y la innovación en la región de Champagne. |

Mundial | Mercados | Vitivinícola | Francia | Competidores | Jueves, 09 Marzo 2023 | |

| Genesus Global Market Report South East Asia March 2023 |  Paul Anderson, General Manager South East Asia – International Sales Manager As the first quarter of the year comes to an end, a new challenge emerges in the country’s swine industry. The Philippines Hog industry was once again alarmed as Cebu province; one of the Philippines’ few remaining ASF-Free provinces, reported the death of thousands of pigs that are believed to be infected with the African Swine Fever (ASF) virus. Based on the data gathered by the Chronicle, no less than 3,600 pigs died in one particular town in Cebu. Unofficial information received from the province noted that authorities are describing the cause of death as hog cholera, and not ASF. Nearby provinces of Cebu made extra precautionary measures to prevent the virus from entering their respective provinces. On international news, the Philippines lifts its ban on the importation of cured pork meat products from Italy. The ban was enforced by the country’s Food and Drug Administration (FDA) in August last year due to outbreaks of African Swine Fever in the European nation. In a memorandum order signed on Dec. 28 by the Department of Agriculture but issued by the FDA on Jan 19, 2023, the ban was lifted “following the minimum standard and parameters to achieve the appropriate level of protection and inactivation of ASF virus.” It added that based on the DA’s Import Risk Assessment on Nov. 8, the “overall estimated risk of ASF introduction through cured meat is low in products such as dry-cured hams.” The order however does not cover other pork meat products from Italy, the FDA said. A Rising Hope From the never-ending reports of the infection of the ASF virus in the country, a rising hope emerges as the Vietnam-made AVAC ASF vaccine begins its clinical trials in the country. Four (4) farms in the Philippines began their ASF vaccine trials using the AVAC ASF Live vaccine through the efforts of a local agricultural product firm. The company said safety and efficacy trials using the AVAC ASF Live vaccine are being conducted, under the supervision of the Bureau of Animal Industry. These trials are expected to be completed in April. The Vietnamese government recently reported that more than 600,000 doses of the AVAC ASF vaccine have been administered in field trials since July last year. Because of the highly favorable results, the Vietnamese government will also start its nationwide distribution of the vaccine to help the local hog farmers. Since 2019, the ASF perished more than half of the country’s swine population, resulting in the loss of livelihoods of local hog backyard raisers, the shutdown of large commercial pig farms, a decline in feed mill operations, and the loss of revenues of allied industries with an estimated economic value of more than P100 billion a year. Thailand Pig price continues to plunge in Thailand Prices of pigs and fresh pork products in Thailand continue to fall as smuggled frozen pork still cannot be curbed. The price of live pigs today is an average of THB 85 (USD 2.5), or a 26% drop year-on-year. Meanwhile, the production cost is an average of THB 95/kg (USD 2.8). This means a loss of THB 1000/head (USD 29) if the pig is harvested at 100kg. Loin price plunges 18% year-on-year to THB 180 (USD 5.2). Slow demand for pork drives the price of weaned pigs down 40% year-on-year to THB 1800 (USD 52). The main culprit for the price fall remains smuggled pork. Although the government has seized over 700 tonnes of smuggled pork since January, it is estimated that this amount is account as only 5% of those pork items taken into the country illegally. It is reported that over a thousand containers are landing unchecked at a seaport about 200km east of Bangkok. A part of it is suspected of containing frozen pork and other meat products. Despite pig farmers are calling for police and customs departments to beef up the smuggled pork control, most of it remains unchecked. A national election is going take place in the next three months. It is hard to expect government agencies to be taking action on any wrongdoing seriously under the caretaking government. The only hope lies at the depletion of smuggled pork. Once depleted, it would be difficult for the smugglers to find cheap frozen pork in the future. Shortage of pork supplies in major exporters such as the US and Spain would lead to global pork price rise. But before that time comes, most farmers in Thailand who cannot withstand the loss would have to go out of the business. We welcome all customers, friends and those interested to discuss our outstanding swine genetics to visit us this week in VIV Asia, Bangkok our booth is 2770

Vietnam The price of the pig now is 48,000 – 49,000 vnd/kg in the North; 47,000 – 52,000 vnd/kg in the center; and 50,000 – 52,000 vnd/kg in the South. Average will be around 50,000vnd/kg. More detail, please see the link: https://vietnambiz.vn/gia-heo-hoi-hom-nay-136-dau-tuan-ba-mien-dong-loat-chung-gia-20226133351760.htm. The Import and Export Department forecasts that pig production in 2023 will continue to face difficulties. Large livestock enterprises believe that it will not be until the beginning of the second quarter of 2023 that the economy will gradually recover, the income of workers will be improved again, helping to increase meat consumption (source: https://vietnambiz.vn/cuc-xuat-nhap-khau-chan-nuoi-heo-trong-nam-2023-tiep-tuc-kho-khan-20233674354902.htm). The global pig industry is still facing many uncertainties (source: https://nhachannuoi.vn/nganh-chan-nuoi-heo-toan-cau-van-dang-doi-mat-voi-nhieu-bat-on/). Directive No. 02/CT-TTg dated January 14, 2023 of the Prime Minister on strengthening the management and control of animal slaughter to ensure disease and food safety (source: https://cucthuy.gov.vn/web/guest/-/ch%E1%BB%89-th%E1%BB%8B-s%E1%BB%91-02/ct-ttg-ng%C3%A0y-14/01/2023-c%E1%BB%A7a-th%E1%BB%A7-t%C6%B0%E1%BB%9Bng-ch%C3%ADnh-ph%E1%BB%A7-v%E1%BB%81-t%C4%83ng-c%C6%B0%E1%BB%9Dng-c%C3%B4ng-t%C3%A1c-qu%E1%BA%A3n-l%C3%BD-ki%E1%BB%83m-so%C3%A1t-gi%E1%BA%BFt-m?redirect=%2F). – According to the Center for Industry and Trade Information (Ministry of Industry and Trade), the information released this week showed that the world economy has appeared bright spots when the US economy showed signs of recovery, the European economy avoided be degraded (source: https://nhachannuoi.vn/nhung-tin-hieu-tich-cuc-tu-kinh-te-trong-nuoc-va-the-gioi/). ASF UPDATE:-

The Philippines

Malaysia

Indonesia

Vietnam Figure 1. Cumulative number of affected communes since January 2020 in Vietnam

Lao People’s Democratic Republic

Cambodia

Thailand

Myanmar

Singapore

India |

Mundial | Mercados | Cárnicos | Miércoles, 08 Marzo 2023 | |

| Coffee with olive oil? Starbucks enriches flavour and texture with EVOO in Europe | An unexpected combination – arabica coffee and cold pressed extra virgin olive oil – has been added to menu boards at Starbucks stores in Italy. Sold under the Oleato brand, the coffee major says the result is ‘velvety smooth’ and ‘delicately sweet’, bringing a ‘new flavour and texture’ to consumers. The company did not disclose at which stage of the coffee making process the olive oil is added, nor whether the decision to include extra virgin olive oil – a mainstay of the Mediterranean diet – in its beverages was informed by nutritional science. Rather, the company suggests Oleato was born out of a recent visit to Sicily by Starbucks founder and interim CEO Howard Schultz, who observed that locals consumed a spoonful of extra virgin olive oil daily. “We are excited to bring an unexpected alchemy of Starbucks finest arabica coffee and oat dairy alternative infused with exactly 1 tablespoon of extra virgin olive oil, transforming the coffee ritual to offer a velvety smooth, deliciously lush new coffee experience,” a Starbucks spokesperson told this publication. ‘Buttery, round flavours and chocolatey notes’Starbucks is collaborating with Sicilian extra virgin olive oil company Partanna on the Oleato line, although details around this partnership were not disclosed. Amy Dilger, principal beverage developer for Starbucks describes Partanna’s olives as ‘uniquely nutty’ with ‘slightly sweet flavours’: “Think of that rich smoothness of a buttery caramel, it’s a natural complement to our coffee.” Infusing Starbucks coffee with Partanna yields a ‘velvety smooth rich texture’, she explained, “with the buttery, round flavours imparted by the olive oil perfectly pairing with the soft, chocolatey notes of the coffee”. This ‘textural experience’, Dilger added, is imparted in both Oleato’s hot and cold formats. The range includes Oleato Caffè Latte, Golden Foam Cold Brew, Iced Shaken Espresso, Iced Cortado, Golden Foam Espresso Martini, and the Oleato Deconstructed – espresso and olive oil infused with passionfruit cold foam. Spotlight on nutritionAlthough Starbucks has not suggested a link between olive oil and potential health benefits, this area is well researched. Olive oil is most associated with the Mediterranean diet, which itself is recognised for preventing disease and ageing. This last year alone has seen a wealth of new research come to light. Out of the University of Seville, research has focused on the cancer- and Alzheimer-preventing qualities of oleic acid (the principal component of olive oil), as well as its associations with lower cholesterol levels. A recent study conducted by researchers from the University of Barcelona found that consumption of extra olive oil during pregnancy increases the level of antioxidants in breast milk and in offspring, and work from the University of South Australia suggests the Mediterranean diet may also help overcome infertility. Comparing the nutritional profile of Starbucks’ Oleato range with its classic range suggests the Oleato line, as expected, has higher calorie content, as well as total fat and saturated fat. Oleato Caffè Latte with Oat Dairy Alternative in Grande beverage size has 336 calories, 23.4g total fat, and 2.9g saturated fat. Starbucks did not provide the macronutrient profile of a standard Caffè Latte with Oat Dairy Alternative, but according to the company website, in Canada a 473ml size has 190 calories, 8g total fat, and 0.5g saturated fat. FoodNavigator acknowledges these products do not offer a like-for-like comparison, as beverage size and beverage/oat milk composition may differ.

Of the Oleato range nutritional information provided, the Oleato Golden Foam Cold Brew in Grande beverage size has the highest calorie content with 397kcal, 300 of which come from fat. Total fat for this beverage is 34.2g and saturated fat, International expansionAlthough launched in Italy last month, Starbucks plans to roll out the Oleato range around the world. “Over the next year, Starbucks Oleato will be thoughtfully introduced in select cities around the world, including in the UK and Middle East,” we were told. “We’re excited to share more about the regional expressions of Starbucks Oleato for customers soon.”

Nutrients

Food Chemistry

Nutrients |

Mundial | Mercados | Clientes | Otros | Aceite | Miércoles, 08 Marzo 2023 | |

| Projections à long terme de la production mondiale de viande |

Rédaction 333 Amérique latine selon des données du Ministère de l'Agriculture des Etats-Unis (USDA). |

Mundial | Mercados | Cárnicos | Producción | Martes, 07 Marzo 2023 | |

| Burdeos arranca miles de hectáreas de viñedo por la crisis del vino |

La región francesa de Burdeos, famosa por sus vinos tintos, ha decidido arrancar parte de sus viñedos para hacer frente a la caída de la demanda provocada por la crisis de precios actual y el cambio de gustos de los consumidores. Según el Consejo Interprofesional del Vino de Burdeos, se han aprobado el arranque de unas primeras 9.500 hectáreas de viñedo, con una prima de 6.000 euros por hectárea, lo que supone un total de 57 millones de euros. Esta medida, que afecta a un 10% de la superficie vitícola de Burdeos, busca reducir el excedente de producción y mejorar la calidad y la competitividad de los vinos de la zona. La decisión de arrancar viñedos no ha sido fácil ni unánime. Los sindicatos agrarios reclaman una compensación mayor, de 10.000 euros por hectárea, y una supresión total de al menos 15.000 hectáreas, lo que supondría una ayuda de150 millones de euros o más. Los sindicatos consideran que unas 35.000 hectáreas de viñedo están en riesgo de desaparecer por la poca rentabilidad que ofrecen. Una superficie para la que el sector productor lleva pidiendo desde el año pasado medidas urgentes y contundentes que impidan "continuar vendiendo con pérdidas y que aumenten las quiebras". Para la Confédération Paysanne, el sindicato agrario minoritario, "este plan muestra claramente que la interprofesional no quiere asumir la magnitud del desastre laboral en curso, del que es principal culpable. Es la economía de una región que se derrumba y la respuesta no es suficiente". Argumentan que el arranque voluntario no es suficiente para resolver el problema estructural del sector, que sufre una sobreoferta crónica y una pérdida de mercado frente a otros países productores. Además, denuncian que el arranque beneficia a las grandes bodegas, que pueden comprar uva a bajo precio, y perjudica a los pequeños y medianos viticultores, que se ven obligados a abandonar su actividad. Por otro lado, algunos representantes del sector se oponen al arranque y abogan por otras medidas, como la reconversión varietal, la diversificación de los mercados o la promoción de la calidad y la sostenibilidad. Consideran que el arranque es una solución a corto plazo que puede tener consecuencias negativas a largo plazo, como la pérdida de biodiversidad, la desertificación rural o la renuncia a la identidad y la tradición vitivinícola de Burdeos. Otra de las medidas que proponen los sindicatos es la destilación de crisis nacional, que cuenta con 160 millones de euros en dos fases y que despierta interés entre los dueños de viñedos bordeleses. "Burdeos podría destilar 400.000 hectolitros de vino según las cantidades y las asignaciones", indican desde el colectivo de viticultores de Gironda. Situación la Burdeos parecida a la que está ocurriendo en España en Rioja, rival de Burdeos en el mercado internacional. De hecho, desde ABRA, la asociación que agrupa a las bodegas de Rioja Alavesa, han solicitado al órgano que regula la Denominación de Origen Calificada Rioja que se elimine el 10% de los viñedos que se han plantado en la última década en lugares "sin vocación vitícola", es decir que no son adecuados para el cultivo de la vid. ABRA afirma en una nota de prensa que esta medida pretende "asegurar la calidad y el renombre" de los vinos de Rioja y prevenir la "sobreoferta" que pone en riesgo al sector. Una propuesta, no obstante, que no ha sido bien acogida por la mayoría del Consejo Regulador. |

Francia | Mundial | Mercados | Vitivinícola | Competidores | Martes, 07 Marzo 2023 | |

| EVOLUCIÓN DEL COMERCIO EXTERIOR DEL SECTOR PORCINO ESPAÑOL TOTAL AÑO 2022 (FEBRERO 2023) |

INFORME SICE

INFORME AVANCE DE SITUACION DEL COMERCIO EXTERIOR SECTORIAL EN NOVIEMBRE DE 2022 (ELABORADO EN ENERO DE 2023)

INFORME SOBRE EL SECTOR PORCINO ESPAÑOL – I. EVOLUCIÓN DE LAS EXPORTACIONES DE PORCINO, POR TIPOLOGÍA DE PRODUCTOS II. PRINCIPALES MERCADOS DESTINO DE LAS EXPORTACIONES ESPAÑOLAS DE PORCINO. ANÁLISIS POR TIPOLOGÍA DE PRODUCTOS II.1. Total Sector Porcino (sin incluir animales vivos) II.2. Animales vivos de la especie porcina II.3. Carnes frescas, refrigeradas y congeladas de porcino II.4. Despojos de porcino II.5. Tocino de porcino II.6. Jamones y paletas curados de porcino II.6.1. Jamones y paletas curados de porcino, con hueso II.6.2. Jamones y paletas curados de porcino, deshuesados II.7. Jamones y paletas cocidos de porcino II.8. Panceta salada de porcino II.9. Embutidos curados y cocidos de porcino II.10. Preparaciones y conservas de porcino II.11. Manteca fundida de porcino II.12. Grasa fundida de porcino

III. EVOLUCIÓN DE LAS EXPORTACIONES DE PORCINO, POR COMUNIDADES AUTÓNOMAS III.1. Total Sector Porcino

IV. EVOLUCIÓN DE LAS IMPORTACIONES DE PORCINO, POR TIPOLOGÍA DE PRODUCTOS IV.1. Total Sector Porcino IV.2. Animales vivos de la especie porcina IV.3. Carnes frescas, refrigeradas y/o congeladas de porcino IV.4. Embutidos curados y cocidos de porcino

NOTA METODOLÓGICA

|

Mundial | Mercados | Cárnicos | Martes, 07 Marzo 2023 | |

| European pork exports fell 15% | Last year the European Union exported a total of 5,203,921 t of pork and pork products, representing a 15% decrease compared to 2021, when, suffering a smaller decrease (-3%), EU exports exceeded 6 million tons for the second time. The main cause of this significant decrease in exports was China, the leading destination, which imported 40% less pork and pork products from the EU last year (1,541,892 t in 2022 vs. 2,574,644 t in 2021). After reaching a 52% share in 2020, the share has been decreasing- to 42% in 2021 and 30% last year. Exports to Hong Kong have also been reduced by almost 50%, and now stand in 13th place with 77,602 t (in 2020 they reached 283,590 t and were in 4th place).  Exports to the United Kingdom, the second leading destination with a 16% share, decreased by 9% to 811,259 tons. Exports to Japan and the Philippines, third and fourth largest destinations respectively, with shares of 9% and 8%, increased by 23% and 21%, reaching 466,511 t and 422,628 t, respectively. Exports to South Korea, with a 6% share, increased by 12% to 318,242 tons. 333 Staf with data from DG Agri. |

Mundial | Mercados | Cárnicos | Martes, 07 Marzo 2023 | |

| The Future of Automation in the Food Industry | By Buffy Hagerman, Marketing Communications Manager at Key Technology The food industry will always be inextricable from our ever-changing health and economic environments, and recent challenges in these areas have brought automation to the forefront. Automation in the food industry has historically been quite challenging — and remains so — due to the need to handle a broad range of nonuniform products while meeting the necessary stringent safety standards. Large food companies are, however, increasingly proving effective, efficient food automation to be possible and are reaping the rewards. Read on to learn more about the current face of automation in the food industry and what it means for production, efficiency, and safety. Applications of automation in the food industryAutomation in the food industry takes many forms. These include: Robotics: Robots are a fundamental underpinning of automation, and today’s food industry robots feature advanced technology that ensures they will remain a key part of the future of automation. Robots can nearly replicate human grabbing and multiaxis movement, yielding massive benefits in harsh environments (such as freezers) as well as lights-out processes. Robots, often in collaboration with human workers, continue to fulfill a vast array of duties on the production line, as well as in picking, sorting, and fulfillment. Integrated conveyor and sorting systems are among the most efficient uses of automation in facilities today. Artificial Intelligence (AI): AI technology is used in several areas in food manufacturing, including visual inspection of livestock and food products for safety and proper handling, as well as indication on the facility floor of whether personnel are carrying out proper safety measures, including proper hygiene, gowning, and handling procedures. Packaging: With today’s advanced automation, even traditionally difficult-to-handle food products such as meat and poultry can be effectively prepared and packaged through automated processes. Automated equipment can dismantle (rather than cut) meat from the bone and accurately package product in the volume necessary — all with little to no hands-on intervention from workers. Drones: Drones play a key role in the farming and agricultural component of food manufacturing, aiding in seeding, planting, fertilizing and applying pesticide, as well as visual inspection of planting areas and other parts of agricultural facilities.

Benefits of automation in the food industryThe automation applications described above are yielding immense benefits. These include: Cost: Automation creates efficiency, which in turn creates cost savings. By enabling facilities to carry out processes in a more productive fashion — increasing speed and throughput — automation can reduce overall production costs while increasing output. New automation infrastructure often requires a significant upfront investment, but this investment will pay itself back in a predictable manner, yielding cost benefits once the break-even point passes. Speed: Production speed is a part of increased productivity and efficiency, but still merits its own mention. Faster production means a better adherence to deadlines, closer adherence to customer requirements, and overall increased customer satisfaction, which can create major business benefits in the long term. While increasing the speed of processes, automation can also free up personnel to carry out higher-value tasks that cannot be completed by machines, further increasing the return on your investment. Safety: Food manufacturing poses numerous risks to workers, including extreme hot and cold environments, exposure to dangerous equipment (for example, cutting and slicing equipment) and concerns about proper food handling (for both employees and end customers). Automation attenuates these risks by using robots and other equipment to carry out the most dangerous processes, while taking workers out of the harsh environments that can pose the greatest risk and discomfort. Handling by automation equipment also vastly reduces the risk of cross-contamination. Resiliency: As mentioned, automation in the food industry has traditionally been considered too difficult to be worth the effort. In today’s food manufacturing landscape, however, automation has enabled continuity and safety in the facility on an unparalleled level, especially in the face of nearly unprecedented demand. Automation is poised to continue expanding and improving now that the benefits are becoming fully realized. These applications and benefits give you the foundation you need to understand the role of automation in food manufacturing today. Buffy Hagerman is Marketing Communications Manager at Key Technology, a leading food processing equipment manufacturer. Hagerman is responsible for marketing initiatives that build awareness of the company’s high-performance digital sorting, conveying and process automation solutions worldwide. |

Mundial | Intersectorial | Producción | Lunes, 06 Marzo 2023 |

Página 6 de 159