Indicadores

| Título del ítem | Sumario | Categorías | Creado | |

|---|---|---|---|---|

| Genesus Global Market Report Europe March 2023 |  Simon Grey, General Manager of Genesus EuropeThere are officially 44 counties that are in Europe, 27 of these are in the EU. Each country is individual with its own market requirements. The comments in this report are general. Across Europe we are seeing record high pig prices and a declining pig herd. Its impossible to know exact numbers, but most indicators are there were about 6% to 7% less total pigs in Europe at the end of 2022 (134.3 million) than the average from 2017 to 2020 (about 143 million). Pig population in Europe 2017 145.5 million 2018 143.5 million 2019 143.1 million 2020 145.9 million 2021 141.6 million 2022 134.3 million Data from Statista suggests pig meat consumption in Europe will fall by 7.2% by 2031 vs a decline in meat consumption of 2.8%. So, what is going wrong for the pig industry in Europe. And can anything be done to stop the decline. Legislation Pig farmers in the European region are the most heavily legislated in the world for both environmental and animal welfare reasons. Regardless of this being wright or wrong or good or bad, the fact is it increases production cost. This extra cost and the cost of modifying farms is putting some farmers out of business. Every country that has ever done “high welfare” has lost about 50% of its pig production! This legislation is also increasing the price of pig meat in the shops for consumers! There is another issue here that European politicians seem to want to ignore. The systems that have the lowest impact on the environment are the most intensive! For the most sustainable pig production we need “High stocking density, a high degree of mechanisation, low labour requirement and efficient use of feed.” This is the exact opposite of what animal welfare legislation is doing with its demands for more extensive systems, more space, bedding etc…. Do we want the highest level of perceived animal welfare or farms with the lowest carbon footprint. We can’t have both! The current loss of production has been accelerated by the increased cost of grain as a result of Russia invading Ukraine in 2022. Despite record high pig prices for much of 2022 producers across Europe have been losing money due to very high feed prices. Disease Parts of Europe have of course been suffering with ASF. This puts restrictions on movement of meat from infected areas, which impacts on sales price in that particular area. However currently we are seeing higher levels of disease and death due to normal production diseases like PRRS. This is in part, as a result of legislation severely restricting the use of some products like zinc oxide in piglet feeds (from 3000 ppm to 150ppm) and continued pressure on the reduced use of antibiotics. This has resulted in higher levels of mortality that are 3% to 4% above where it was across nursery and finisher farms in parts of Europe. Zinc was removed due to “potential risks to the environment”. Clearly the legislators did not take into account the actual welfare impact this has on pigs (more sick and dying) and the ACTUAL IMPACT on the environment of dead pigs who have consumed feed etc and need to be disposed of in incinerators! Reduced Consumption! Here there are some very interesting facts! First look at this table from OurWorldInData.org

Take careful note of the greenhouse emissions from pigs vs Coffee and Chocolate – which are both 3 time higher per kg than pork! We are told one of the reasons meat consumption is falling is because of its environmental impact. Pork consumption is expected to fall by 7.2% in Europe by 2032. Europe consumes about 18% of pork in the world. By comparison Europe is the largest importer and consumer of Coffee (32%) and Chocolate (36%) in the world. Average Chocolate consumption in the world is 0.9kg per person. In Europe its 5kg and in Germany (the country most actively legislation against pig production currently) its 11kg… Chocolate consumption is expected to increase by 4.79% by 2027 and Coffee consumption is increasing at 2.77% per year currently. So the same Europeans that want to eat less pork because of its impact on the environment are the same ones that want to eat and drink more and more of a products that have 3 times more impact. Sort of rules out the environmental argument. Why do people want more and more Chocolate and Coffee? IT TASTES GOOD!! More numbers from the top of this report. In Europe by 2032 Pork consumption is expected to reduce by 7.2% vs total meat consumption by 2.8%. If you do the maths of this it means that most of the total reduction in meat consumption will be pork! These figures are predictions, but tally with what has been happening in general with pork consumption in Europe. Whilst total consumption has been increasing, pork has at the very best been static. Why do people choose to eat one product over another. Number one reason is IT TASTES BETTER! We can’t control how governments legislate, we can’t control global grain and pigmeat prices. We can however control how the pork we produce TASTES. We know that BETTER TASTING product drives demand. Genesus Jersey Red Duroc is well known as the global leader when it comes to high marbled tasty pork. This in combination with Genesus F1 gives a consistent highly marbled product that is driving demand in many markets around the world. This demand is also driving higher prices. People eat more chocolate and drink more coffee, why would they not eat more pork if it was TASTY! |

Mundial | Mercados | Cárnicos | Martes, 28 Febrero 2023 | |

| Following Cyclone Gabrielle, New Zealand Winemakers Assess Damage, Prepare for Harvest | Two weeks after Cyclone Gabrielle devastated the North Island of New Zealand, residents are still assessing the destruction. The storm is already considered the costliest tropical cyclone on record in the Southern Hemisphere, with damages estimated to be upward of $8 billion. The cyclone, which killed at least 11 people, hit the farming and winegrowing regions of the North Island particularly hard. For winemakers in areas such as Hawkes Bay and Gisborne, the timing could hardly be worse. Harvest is just weeks away. Some vineyards were flooded, and in certain areas, tons of mud carried by the waters buried vines and pushed into buildings, leaving bottles and equipment trapped under heavy muck. But many New Zealand winemakers aren’t eager to put the spotlight on their losses. "We feel that the loss of life and destruction to homes and personal businesses is so much bigger than the wine story," said Warren Gibson, winemaker at Trinity Hill in Hawkes Bay. His somber tone is consistent among the island’s winegrowing community—some winemakers are reluctant to go on the record to report damage, focusing instead on the loss of human life and damages to their communities. BuriedA tropical cyclone is an organized, rotating storm system that originates over warm tropical or subtropical waters. Known as hurricanes in the northern Atlantic and typhoons in the northwestern Pacific, the storms are cyclones in the Indian and southwestern Pacific oceans and are just as deadly. New Zealand is no stranger to storms, but Gabrielle was especially dangerous. ![linden Estate]](https://mshanken.imgix.net/wso/bolt/2023-03/ns_linden_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=320 320w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_linden_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=320 640w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_linden_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=384 768w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_linden_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=828 828w)

The vineyard at Linden Estate was flooded with mud and slit, burying parts of many vines. (Cephas) While vintners were aware the cyclone was en route, no one could have predicted the volume of water that came with Gabrielle—all days before harvest was expected to begin. The total rainfall was between 14 and 18 inches, which included a 24-hour period of downpours, from Feb. 13 to 14, that saw more than three times as much rain as the February average. The cyclone comes after a January storm that caused widespread flooding. Gabrielle’s high winds and waters washed away coastal roads and destroyed bridges, while landslides created more damage. On Feb. 14, the country declared a national state of emergency for just the third time in its history. Early estimates are that 10,000 New Zealand residents were left homeless in the wake of Gabrielle. Prime Minister Chris Hipkins called the cyclone the country’s "biggest natural disaster" of the 21st century. Nick Picone, chief winemaker at Sacred Hill in Hawkes Bay, reports that approximately 200 acres of Sacred Hill's vines were "catastrophically affected." He says it’s unknown how much of those grapes will be harvestable. "Some vineyards have been lost completely under silt, like our Dartmoor vineyard," explained Picone. "Approximately 37 acres there have gone completely under and will not be recoverable. This was Sacred Hill’s first vineyard, which was planted in the 1980s. The costs and benefits of trying to recover versus replanting must be carefully considered." ![Dartmoor vines]](https://mshanken.imgix.net/wso/bolt/2023-03/ns_dartmoor_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=320 320w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_dartmoor_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=320 640w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_dartmoor_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=384 768w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_dartmoor_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=828 828w)

Vines in the Dartmoor vineyard were submerged in mud, likely ruining this year’s crop. (Kerry Marshall/Getty Images) The New Zealand Herald reports that winemaker Philip Barber, using a shovel, dug out 12,000 bottles of wine at Petane Wines in Esk Valley. The wine was stuck in a storage room behind nearly 10 feet of silt and mud. The bottles will be tested to make sure the wine is ok and hopefully auctioned off to recoup costs. Harvest in a disaster zoneThe surrounding devastation is another factor, with winemakers unable to reach some vineyards or move equipment. "We are also currently cut off from our Rifleman’s vineyard farther up the valley, with no bridge access across the river," said Picone. "We are working on scenarios for how to get this fruit out of the vineyard in the next week or two. Vineyards that were flooded but not up to the fruit zone should still be harvestable, but any vineyard that was flooded up to the fruit (evident by silt deposits in the bunch zone) will need careful testing to ensure the fruit is safe to harvest. We don’t have any vineyards in this position." Despite worst-case scenarios, Kiwi winemakers are careful to not discount the vintage entirely. The region’s largest wine region of Marlborough, on the South Island, wasn’t affected dramatically. As for the North Island, "This week, those who are able are assessing vineyards, fruit and looking to the upcoming harvest, while assisting those who are less well off," said Gibson. "For many, there is still good fruit out there. The vintage will be difficult, but it will not be impossible. Hawkes Bay wine folk will rally and there will be good wines produced." Julian Grounds, chief winemaker at Craggy Range in Havelock North, is counting his blessings. "From a Craggy Range perspective, we escaped with no damage to vineyards and buildings and consider ourselves very lucky," Grounds said. "This was also the case for the wider Gimblett Gravels and Bridge Pa wine regions, as the river protecting the area held its bank but burst farther down.” ![flooded car]](https://mshanken.imgix.net/wso/bolt/2023-03/ns_kiwiflood022423c_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=320 320w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_kiwiflood022423c_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=320 640w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_kiwiflood022423c_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=384 768w,https://mshanken.imgix.net/wso/bolt/2023-03/ns_kiwiflood022423c_1600.jpg?auto=compress,format,&sharp=5&vib=20&q=70&w=828 828w)

A swamped car was pushed off the road near this vineyard. Damage to roads and bridges is making harvest daunting. (Kerry Marshall/Getty Images) "Unfortunately, around some of the areas located within 15 to 30 minutes [from us], flooding has caused significant damage," he added. "And that’s an absolutely devastating outcome, as [it] will likely mean replanting. The region of Esk Valley was one of the hardest hit, so our thoughts are with them." Grounds adds that Craggy Range is approximately one week from harvesting Chardonnay, and he is hopeful the current dry, sunny weather will continue. Picking dates were already pushed back by a few weeks compared to 2019–2021 harvests, due to a cold and wet growing year. Paul Brajkovich of Chardonnay powerhouse Kumeu River reported, "We are relatively unscathed in Kumeu. The cyclone came through last week; the flooding did not reach the winery, but the winds blew over a few trees and at least helped dry things out a bit. Coastal areas close to us, such as Muriwai, Piha and Bethells, have suffered quite a bit of damage, with slips and a number of houses now uninhabitable." Brajkovich said a Dartmoor grower, whom the winery typically purchases grapes from, had to escape floodwaters of up to 13 feet. It’s believed their crop was destroyed. He adds that Kumeu River started harvesting Pinot Gris and will begin picking Chardonnay next week. "This is not the fabulous vintages of 2019 and 2020, but at least the weather is fine and we are getting some decent stuff." Stay on top of important wine stories with Wine Spectator's free Breaking News Alerts. |

Mundial | Mercados | Vitivinícola | Competidores | Martes, 28 Febrero 2023 | |

| Attest: Nearly 3 in 4 Americans Will Stick With Private-Label Purchases Even if Inflation Eases | Customer In Supermarket. Black Man Doing Grocery Shopping Standing With Cart Choosing Food Product Indoors. African American Guy Buying Groceries In Food Store. Selective Focus, Copy Space

As inflation takes its toll on grocery budgets, new research from Attest reveals that many consumers have solidified their preference for private-label brands. Attest surveyed 2,000 U.S. consumers, finding that more than half (58%) are “very likely” to buy from private-label brands as opposed to more expensive big-name brands, while 27% are “somewhat likely.” Only 4% are “unlikely” to buy private-label. Taking it a step further, 74% would make the switch from big-name brands permanent, noting they would “definitely” (34%) or “probably” (40%) continue purchasing private-label if price was no longer a concern. Only 9% wouldn’t keep buying private-label products. When choosing where to shop these days, most American consumers are chasing value. The majority (89%) are likely to go bargain hunting when grocery shopping, including looking at advertisements (58%), visiting different supermarkets (42%), and checking online (34%) to find out where the best deals are. Most consumers (63%) say low prices are most likely to motivate them to choose a specific supermarket, while high prices or a lack of deals have driven consumers away from certain retailers completely. Product discounts are most likely to incentivize food and beverage purchases compared to other offers like buy-one-get-one deals, pre-inflation price freezes, and extra loyalty points. But those discounts don’t have to be significant — nearly 30% of consumers would bite on a minimum discount of 20%, 22% would buy a product with a 30% discount, and 19% would be persuaded by a discount of 10% or less. In their search for value, consumers are becoming long-term fans of private-label. But some are unwilling to make the switch, most likely because they’re still able to afford trusted household brands (29%). Some also report that private-label products don’t taste as good (28%) or have lower quality ingredients (25%). But, overall, private-label brands are thriving under current economic conditions. “American shoppers have changed in behavior and have acquired a real taste for private-label brands due to inflation’s impact on the cost of grocery and household products,” said Jeremy King, CEO and founder of Attest. “This poses a significant challenge to well-known brands that can’t compete on price and who may end up the losers here as these shifts in shopping habits may be permanent for several important sub-segments.” See Attest’s full 2023 U.S. Food & Beverage Trends report for more insights. |

Mercados | Mundial | Lunes, 27 Febrero 2023 | |

| Latin America: Swine production and trade in 2022 |

Although Chile saw decreases in all indicators, at the regional level there was an increase in production and in import volumes, which contrasted with the generalized decrease in exports. In this regard, the significant increase in apparent consumption was due to strong demand for pork throughout the year, which contributed to the growth of local production (despite the sustained increase in imports), thus achieving a higher share of imports in consumption, from 80.2% in 2021 to 80.4% in 2022. The context in the Latin American swine industry in 2022 was comprised of high raw material prices and production costs in general. In addition, the international economic situation, which brought record levels of inflation, among other macroeconomic imbalances, contributed to price volatility and affected profitability indexes for pig farmers. However, the results obtained were very positive and industry projections for 2023 are favorable, given the greater positioning of pork in household consumption, and the expected increase in Southeast Asian imports, which would give a new boost to Latin American exports.  333 Latin America with data from the Brazilian Institute of Geography and Statistics (IBGE) and COMEX STAT - Brazil/ SIAP and GCMA - Mexico/ DANE and Porkcolombia - Colombia/ ODEPA - Chile/ MAGyP - Argentina.

|

Mundial | Mercados | Cárnicos | Lunes, 27 Febrero 2023 | |

| Las exportaciones españolas de vino baten récord de facturación en 2022, con 2.980 millones de euros | El año 2022 cierra de forma positiva para las exportaciones españolas de vino que lo rematan con un récord de facturación, alcanzar los 2.980,2 millones de euros. Pese a perder un 9% en volumen (2.089,5 millones de litros), la realidad es que en valor son casi 90 millones más que en 2021.Un informe del Observatorio Español del Mercado del Vino (OeMv) destaca que las exportaciones españolas de vino han alcanzado una facturación récord en el año 2022, con 2.980 millones de euros, que suponen casi 90 millones más que los registrados en 2021. Precisamente desde OeMV hacen hincapié en que es una situación contra todo pronóstico «dentro de un contexto de inflación generalizada y en un año marcado por una gran incertidumbre comercial». Añaden que en términos de volumen, sin embargo, se registró una caída del 9%, hasta los 2.089,5 millones de litros, 213 millones de litros menos que en 2021.  Desde febrero de 2021, solo ha caído la facturación de las exportaciones españolas de vino en los meses de marzo de 2022 (-23,6%) y de noviembre de 2022 (-1,8%), aumentando el resto. De hecho, en el año 2022, los meses de febrero, abril, mayo, junio, julio, agosto y septiembre, habían sido los más elevados, respectivamente de la serie histórica. Esta evolución ha permitido cerrar 2022 con un récord de facturación, aunque sin superarse la barrera de los 3.000 millones de euros. En términos de volumen, la caída ha sido del -9%, hasta los 2.089,5 millones de litros. Es decir, se han dejado de exportar casi 213 millones de litros, de los que casi 150 millones son de vino a granel y se han facturado, 89,6 millones € más. Los datos por productos y por mercadosPor productos el informe recoge que los que más aportan al crecimiento global de la facturación en 2022 son: los vinos a granel (+12% o 55,8 millones € más), los vinos sin DOP envasados (+6% o 25,9 millones € más), los espumosos (+5% o 24,4 millones € más), junto a los vinos en BiB (+8,4 millones €). Y en términos de volumen, son los vinos a granel (-11% o 149,8 millones de litros menos), junto a los vinos tranquilos envasados (-10,5% o 77,6 millones de litros menos), los que lideran las pérdidas. En el análisis por mercados en el caso del vino a granel, son Italia, Alemania, Portugal y Francia los que más cayeron en volumen, dejando de comprar entre los cuatro 111,4 millones de litros en 2022. Francia y Alemania, fueron también los que más aumentaron su gasto en granel español (+30 millones €, Francia y +19,5 millones €, Alemania). Destaca la buena marcha de las exportaciones de granel a Marruecos (+9,2 millones de litros) y Reino Unido (+7,5 millones).  En el caso del vino envasado, EE.UU. se convierte, con 258,1 millones € (+11%), en el primer destino en valor para los envasados españoles, mientras Alemania lo es en volumen, con 83,4 millones de litros (-12%). En el lado negativo, fueron mal las ventas en valor a Alemania, Reino Unido, Canadá y China (-35% en valor y -46% en volumen). En el lado positivo, destaca el aumento registrado por México (+41% en valor y +33% en volumen). Por último, si se tiene en cuenta la variación interanual, se aprecia en los últimos meses de 2022 un repunte de las exportaciones en volumen, suavizando su caída, mientras también se suaviza el crecimiento de la facturación y del precio medio. Este informe está realizado por el Observatorio Español del Mercado del Vino y disponible gracias al acuerdo de colaboración con la Organización Interprofesional del Vino de España. Artículos relacionados |

Mundial | Mercados | Vitivinícola | Domingo, 26 Febrero 2023 | |

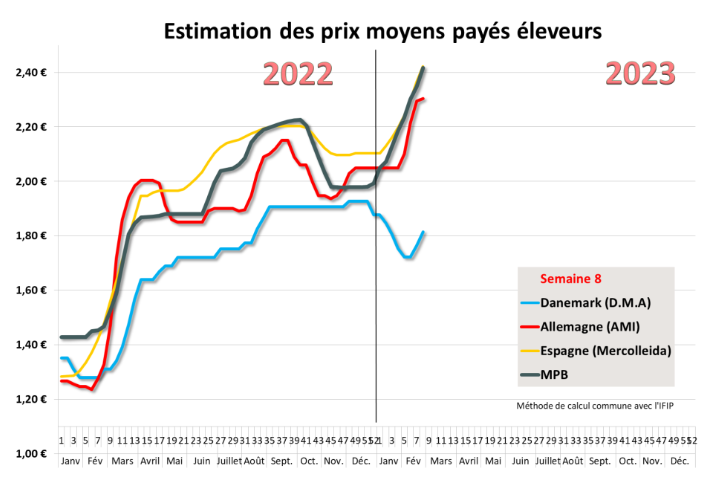

| Prix du porc: Tendances contrastées en Europe entre hausse et stabilit | C’est le cas en Allemagne où la référence officielle a été reconduite après 28 cents de hausse en 3 semaines que le secteur de la viande va devoir répercuter à un rythme plus lent. D’autre part, selon certains commentaires nord-européens, la période du Carnaval est traditionnellement peu propice à un commerce actif alors même qu’une certaine résistance aux hausses se renforce dans le secteur de la viande. Mais il est vrai aussi que les stocks congelés ne sont pas élevés, que les fêtes de Pâques se rapprochent et que la saison des barbecues doit être anticipée avant que les pièces aient encore enchéri. En Belgique, la demande de porcs vifs est bonne, notamment à l’exportation et en particulier vers l’Espagne. Cela explique, entre autres, le faible niveau d’abattage qui s’est replié récemment de 18%.  En Autriche, la tendance du prix a suivi l’exemple allemand. Les offres sont pourtant faibles et cela ira en s’amplifiant car le manque de porcelets ne permet pas des remplissages réguliers dans les élevages. Au Danemark, le prix d’acompte a récupéré 12 centimes ces 3 dernières semaines mais reste encore très éloigné des autres références européennes. En Espagne, le cours a enregistré une hausse de 4,5 cents du kilo vif la semaine passée. En Espagne aussi, le secteur de la viande oppose de plus en plus de résistance face à ces hausses du prix du porc. Les ventes à l’export ne donnent aucun signe de reprise et le marché de la viande en Europe reste encore bien approvisionné et donc bien concurrencé. Toutefois, le manque de porc est grandissant et se traduit par une baisse importante des abattages depuis le début de l’année. Les poids tendent à baisser depuis quelques semaines mais restent record.

En Italie, la hausse du prix du porc se poursuit également avec une revalorisation de 4,3 cents du kilo vif. Le marché se caractérise toujours par une offre faible et une demande de saison, c’est-à-dire sans ressort. Contre toute attente, la dernière hausse a été répercutée sur le marché de la viande. Les poids baissent, la faiblesse des offres va conduire les abattoirs à réduire leur activité. Aux Etats-Unis, le prix du porc est en hausse régulière depuis un mois, le niveau de prix reste toutefois inférieur à ceux des 2 années antérieures, années record après 2014. Les abattages de la semaine 7 se sont élevés à 2,5 M de porcs, en légère hausse par rapport à la semaine précédente et à l’année passée. Les poids reprennent 200 grammes environ. Le prix du porc en Chine remonte légèrement et se situe à 15,9 CNY le 24 février 2023 (2,17 €). Depuis le début de l’année, la courbe du prix du porc 2023 suit de très près celle de 2022. Selon différents médias, 20 000 tonnes de viande de porc seront retirées du marché pour reconstituer les réserves d’Etat et pour soutenir le prix du porc. MPB : 7 centimes de hausse dans la semaine à 2,246 eurosLes 2 séances hebdomadaires se sont achevées sur des hausses maximum : + 2 cents le lundi 20 février et + 5 cents le jeudi 23 février. Le prix atteint ainsi un nouveau record à 2,246 euros. Le scénario est le même depuis le début de l’année, à savoir que les abattoirs enchérissent rapidement au niveau de la vente obligatoire pour assurer une partie de leur approvisionnement face à une offre en fort repli. C’est la cinquième fois depuis le début de l’année que le cours atteint son maximum autorisé par la convention de marché pour une vente du jeudi. Certains abattoirs ont ralenti leur activité ce qui se traduit par une activité en baisse de 4 416 porcs pour 350 357 porcs abattus. Par rapport à l’activité de la même semaine 2022, la baisse est de 26 200 porcs (-7%). Les poids moyens ont repris 293 grammes à 95,83 kilos mais demeurent 560 grammes inférieurs aux poids de la même semaine 2022. Depuis le début de l’année, sur les 8 premières semaines, les abattages de la zone Uniporc Ouest sont en baisse de 163 120 porcs (-5,3%), soit 20 390 porcs de moins par semaine. |

Mundial | Mercados | Cárnicos | Sábado, 25 Febrero 2023 | |

| The Wine & Spirits Industry Has a New Home | Paris, February 16th, 2023 – The 4th edition of Wine Paris & Vinexpo Paris delivered on its promise with a hugely successful outcome. International exhibitors and visitors were well represented with attendance markedly higher this year, consolidating the event’s firm positioning in the wine and spirits industry calendar. This strategic gathering, combining business with a warm atmosphere, has now become a vibrant focal point for a united industry.

Wine Paris & Vinexpo Paris 2023 welcomed 3,387 exhibitors (20% more floor space and 25% more international exhibitors than in 2022), from 42 countries, and 36,334 visitors (+41% from 2022), including 38% international attendees from 149 countries. That’s an 85% increase in international visitors. The top 5 visitor countries outside of France were Belgium, the United States, Italy, the United Kingdom and Germany. The Vinexposium group’s digital portal enhanced opportunities both for business and for engagement with other industry members. A total of 6,330 meetings generated 12,279 conversations between producers and buyers. “Wine Paris & Vinexpo Paris is up to standards in terms of a trade show. We have seen our existing customers and opened markets we do not cover. In Paris we meet a wide variety of customers from a different sphere of influence”, stressed Konstantinos Arvanitakis, from the Export Department of Alpha Estate (Greece). A Recognized Event Placed under the High Patronage of Mr. Emmanuel Macron, President of the French Republic, this year’s exhibition was visited by 3 French ministers and 15 ambassadors (South Africa, Albania, Argentina, China, Spain, the United States, Greece, Italy, Japan, Kazakhstan, Luxembourg, Portugal, Serbia, Switzerland and Uruguay). At the official opening ceremony of Wine Paris & Vinexpo Paris, Marc Fesneau, France’s Minister of Agriculture and Food Sovereignty, announced that the event was “a showcase for French excellence, allowing the quality and authenticity of what we produce to be recognized beyond our borders”. At the official opening of Be Spirits, Olivier Becht, Minister of Foreign Trade, Attractiveness and the French Overseas, applauded a record high trade surplus of 16 billion euros generated in 2022 by members of the French wine and spirits industry, who he called “export champions”, stressing that winegrowers represented “the answer”. Olivia Grégoire, Minister in charge of Small and Medium Enterprises, Commerce, Trades and Tourism, also highlighted the “success of an exhibition bringing together members of the wine industry in France and showcasing the excellence and time-honoured expertise passed down through the generations”. A Landmark Year for Be Spirits The Be Spirits area, which this year occupied a designated hall covering 43% extra floor space with 44% new exhibitors compared with 2022, was also a resounding success. “Be Spirits is the absolute go-to place in France to reach out to an international clientele. It brings together the entire spirits community and illustrates the intellectual appetite for spirits and craft beverages. Visitors thronged throughout the three days”, enthuses Olivier Goujon, Director of the national Armagnac marketing bureau (BNIA)/Armagnac Style (France). An ON and OFF Program Creating a Vibrant Wine & Spirits Experience The ambitious and refreshed ON program proved to be extremely popular. Over 3,249 people attended various masterclasses, conferences and panel discussions over the three days. The sommelier industry was also honoured with events that included the Chef & Sommelier Duos, the Battle of the Female Sommeliers and Vinexpo Challenge. “Wine Paris & Vinexpo Paris is an excellent show, very well organized. The masterclasses were interesting and business wise, the exhibition was very productive for me and my company. Wine Paris & Vinexpo Paris gets better every year and has become a must-visit event in the wine industry. I will be back for the next edition in 2024”, commented Danio Braga, Wine Director for Brazilian group Fasano. For its OFF line-up, Wine Paris & Vinexpo Paris developed an incredible selection of venues outside the exhibition so that conversations could continue in the heart of Paris. Across the city, 180 bars and restaurants (chosen for the quality of their cuisine, the experience and the atmosphere) provided food and drinks choices and events focusing on wine and cocktails. 2024 Here We Come! Wine Paris & Vinexpo Paris has already begun to prepare for its next edition. Echoing the international drive rolled out by the Vinexposium group through the events it hosts on the leading consumer continents – in New York, Singapore, Quebec, Rioja, Seoul, Amsterdam and New Delhi – Wine Paris & Vinexpo Paris will be attracting even more French and international industry members in 2024. “Wine Paris & Vinexpo Paris 2023 is a success both for its visitor attendance, which showed strong growth, and for the quality of the trade conversations. This edition has demonstrated that it is possible to design an exhibition with an increasingly broad line-up of events and products that combine wine and gourmet food, business and a warm atmosphere. The success acts as a compass for the Vinexposium team across-the-board. It encourages us to push the boundaries even further and think even bigger so that we can live up to the trust that is placed in us. Wine Paris & Vinexpo Paris is the meeting point for a world in motion whose international reach is constantly growing”, concludes Vinexposium CEO, Rodolphe Lameyse. |

Francia | Mundial | Eventos | Vitivinícola | Jueves, 23 Febrero 2023 | |

| Cyclone Gabrielle – New Zealand wine industry update | By Lucy Britner | 23 February, 2023  The trade organisation for New Zealand wine has said the extent of the damage to vineyards caused by Cyclone Gabrielle is still being assessed. The cyclone hit the North Island on February 12, moving down the east coast - home to both the Hawke's Bay and Gisborne wine regions. New Zealand prime minister Chris Hipkins called it the biggest natural disaster the country has faced this century. New Zealand Winegrowers CEO Philip Gregan said the clean-up process has started in Hawke’s Bay and Gisborne vineyards, with many wineries turning their attention to the harvest. “Cyclone Gabrielle has occurred on the cusp of the busiest time of year for the industry,” he said, “just as the 2023 vintage is about to begin, and it is a major blow for affected growers and wineries throughout Hawke’s Bay and Gisborne. We have been working with our regional associations and government agencies to support and help them access the resources they need to ensure the future viability of their vineyards.” As the extent of the damage in flooded regions becomes clearer, Gregan said many winegrowers who have not been as extensively affected are moving on from the initial phase of response, to start the harvest. “We have a large number of vineyards in both regions that have not been as significantly impacted by Cyclone Gabrielle, and these winegrowers are beginning to harvest their crop, with many producers still feeling positive and looking forward to a high-quality vintage,” added Gregan. Meanwhile, others, who have suffered damage to their vineyards and wineries, need help to begin recovery. “Those affected have a long road ahead of them to assess the damage, undertake the clean-up and consider their future,” he said. “The recovery funding announced by the Government this week is a good start to making this all possible, and future financial relief that is expected to be announced in due course will be appreciated. “The ongoing challenges over the past few years have proven the resilience and adaptability of the New Zealand wine community, and the impact of Cyclone Gabrielle has been met with the same strength and determination." To donate directly to the Hawke’s Bay and Gisborne wine communities, click here. Related articles: |

Mundial | Producción | Mercados | Vitivinícola | Jueves, 23 Febrero 2023 | |

| Argentina’s ‘white revolution’ moves to newer sites |

By Jo Gilbert Published: 24 February, 2023 Dubbed the ‘Queen of Torrontés’ thanks to her pioneering work at Sucesión Michel Torino winery in Cafayate, Susana Balbo has form when it comes white winemaking. Now, the work continues to move that journey onwards with the recent move to San Pablo. Last year, the team at Susana Balbo’s eponymous winery planted around 10ha on the site, which sits by neighbouring Gualtallary. Read more: Amanda Barnes: Argentina makes its move - Harpers Wine & Spirit Trade News Harpers took part in a tasting of the broader range at 67 Pall Mall earlier this week, where viticulturalist and general manager, Edgardo aka ‘Edy’ Del Pópolo, led a tasting of both whites and reds. Those around the table agreed that the wines were a world away from what would have been possible 20 years ago, with – in the case of Torrontés, which played a starring role – precise, clean wines taking the place of oily, more rustic characteristics which were more typical of earlier iterations. “Argentina has never made the white wines we are making today,” Del Pópolo told Harpers. “Altamira with its fantastic alluvial chalky soils provides the backbone for some of our most sought-after white wines, such as Susana Balbo Signature White Blend and Susana Balbo Signature Barrel Fermented Torrontes. Whereas Gualtallary, with its strong personality, is the perfect source for Chardonnay for our BenMarco Sin Limites.” “San Pablo sits at 1,400m elevation and is extremely cold,” he added. “I have given it the name of ‘land of whites’. San Pablo is an amazing place: both San Pablo and Gualtallary are fascinating places for white wines. But with Gualtallary, you can also have Malbec and Cabernet Franc. Whereas, if you asked me about those varieties in San Pablo, I would probably challenge you.” In his search to tap into the “hidden potential” of unexplored sites, Del Pópolo revealed his decision to plant in San Pablo last year, alongside a number of other projects. For example, Del Pópolo also recently came to the rescue of around 1,500, 80-year-old Malbec vines. Pulled up by property developers, Del Pópolo stepped in and transported the load in three large trucks to vineyards in Gualtallary. He then soaked the roots in water and nutrients before replanting, incredibly losing just 50 of the plants in the process. The first wines will be produced next year. Elsewhere, the winery has finally completed its journey to convert its vineyards to organic production, while continuing to make wines which aim to show “determined character and personality”, linked to site. This includes wines like the Susana Balbo Signature White Blend 2022, which is “more about the place, Altamira, rather than its three varieties, Semillon, Sauvignon Blanc and Torrontés”, said Del Pópolo. Altamira, one of Susana Balbo’s focus regions, is roughly the size of Burgundy, approximately 29,000ha and is split between the Tupungato, Tunuyan and San Carlos sub-zones. Gualtallary meanwhile is a crowded winemaking place, with names like Adriana (Catena), Zuccardi and Dona Paula standing shoulder-to-shoulder in vineyards. Susana Balbo continues to be an exception in Argentina, which is dominated by red production. At her family winery, established in 1999, more than 40% of the wines produced are whites or rosés. A selection of all three will be available to taste and the upcoming Enotria Portfolio Tastings on Monday 27 February in London and Wednesday 1 March in Edinburgh. |

Mundial | Competidores | Mercados | Vitivinícola | Jueves, 23 Febrero 2023 | |

| Produits laitiers : ralentissement du commerce mondial en 2022 |  Les échanges commerciaux de produits laitiers sur le marché mondial ont reculé de 2 % en 2022, en équivalent matière sèche du lait, calcule Global Dairy. Cette baisse est le reflet du recul de l’offre mondiale et de la demande, notamment de l’ensemble Chine/Hong-Kong, à cause de la flambée des prix. A noter que les États-Unis se distinguent avec une belle envolée de leurs envois. Sur le seul mois de décembre, la baisse est de 1,8 %, recul imputable en premier lieu à la baisse des exportations néo-zélandaises de poudre grasse vers l’ensemble Chine/ Hong-Kong. Beurre et lactosérum étaient aussi un peu moins échangés sur le marché mondial, mais poudres de lait écrémé, fromages et matières grasses affichaient des progressions. Les exportations de produits laitiers de la Nouvelle-Zélande vers la Chine évoluentEn janvier, les achats chinois de poudre grasse à la Nouvelle-Zélande sont restés limités (-5,5 %), mais l’île océanique fait évoluer son mix produit avec davantage de poudre de lait écrémé, dont elle a exporté au total 51 300 tonnes en janvier, 70 % de plus que l’an dernier, et 55 % de cette croissance était à mettre sur le compte de l’ensemble Chine/Hong Kong. Les exportations de matières grasses y ont aussi progressé de 12,9 % à 10 750 t. |

Mundial | Mercados | Lácteos | Jueves, 23 Febrero 2023 |

Página 8 de 159